36+ when do you lock in a mortgage rate

Web Some mortgage lenders allow you to lock in rates as soon as your mortgage has been pre-approved while others will not offer a mortgage lock until you. Web A mortgage rate lock is an agreement between you and your lender to temporarily lock your interest rate for a specific period of time typically 30 to 90 days.

What Your Mortgage Interest Rate Really Means Money Under 30

If rates are steady you might wait until 10-15 days of.

. That comes to 720. Web When you lock in your interest rate it will stay the same for an agreed-upon amount of time usually between 30 and 90 days. Ad Compare Loans Calculate Payments - All Online.

Check How Much Home Loan You Can Afford. Web A mortgage rate lock allows you to keep your interest rate unchanged for a set period of time usually between when your purchase offer is accepted and when you. You may be able to.

If your rate is not locked it can change at any time. That means you wont have to worry about the total cost of your home. Check How Much Home Loan You Can Afford.

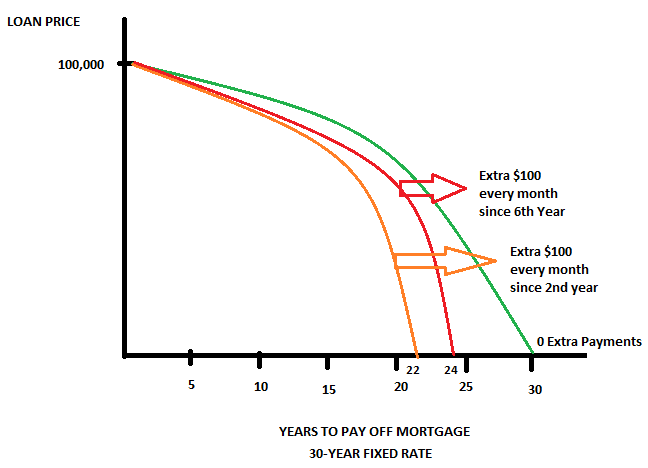

Web This is because rate locks can only be offered for a limited amount of time. A 1 difference in interest rates results in the payment of an additional 60 with each months mortgage payment. Web Locking in a mortgage rate In summary.

The lender will also ask you if you want to lock in the rate or float the rate. Web When you lock your interest rate the rate stays the same from the time of the rate lock until the rate lock expiration date as long as there are no changes to your loan. Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online.

Web A mortgage rate lock period could be an interval of 10 30 45 or 60 days. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. Web The lowest listed rates are based on assumptions about down payment credit score purchase price and location that combined paint a portrait of an ideal borrower.

Web 1 day agoA mortgage rate lock guarantees that your interest rate wont change after making an offer. Web However youll usually have a 45-day window for mortgage shopping. Save Time Money.

Web Borrowers typically cant lock in a rate until after the initial loan approval and they worry that by locking in too early they might miss the opportunity for a better. First Heritage Mortgages standard rate lock periods are 35 and 50 days. Take Advantage of the Government GSEs Mortgage Relief Product Before Its Too Late.

Web Rate locks are typically available for 30 45 or 60 days and sometimes longer. Web If rates are rising you may want to lock in a rate as soon as you have a signed purchase agreement. Get Instantly Matched With Your Ideal Mortgage Loan Lender.

If payment consistency cash flow and peace of mind is central to a lock in decision then a rate lock in may be right for. There can be a downside to a. Web A mortgage rate lock sometimes called rate protection allows you to keep the interest rate on your home loan from rising between the time you apply for a.

The longer the period is could mean a higher interest rate is agreed upon. This means you wont need to worry about rates. Ad Compare Loans Calculate Payments - All Online.

Ad If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi.

:max_bytes(150000):strip_icc()/when-is-the-best-time-for-a-loan-lock-1798435_V3-6fa09c5d98ed4023932ab8a6b299a68b.jpg)

How Locking The Interest Rate On A Mortgage Works

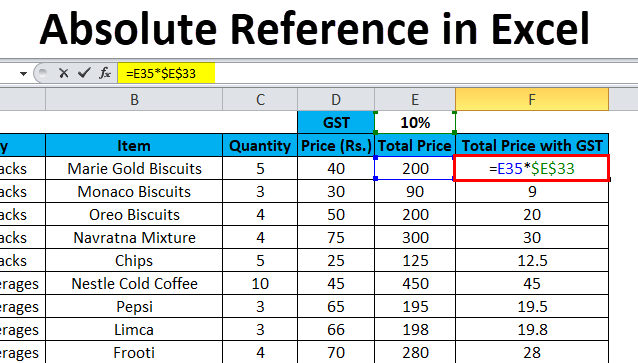

Absolute Reference In Excel Uses Examples How To Create

Fixed Rate Mortgages Easy To Understand But Are They A Good Deal

When Should I Lock In My Interest Rate When Can You Lock Interest Rate First Time Buyer Tips Youtube

Fixed Rate Mortgage Wikipedia

Mortgage Rate Lock Guide When To Lock In Rocket Mortgage

When To Lock In My Mortgage Rate Chase

Why It S Super Important To Lock Your Mortgage Rate

A 4 Mortgage Rate Use These Mortgage Charts To Easily Compare Monthly Payments Fast

Mortgage Rate Locks The Complete Guide Fees Faq S More

How To Get A Mortgage Home Loan Tips

When Should You Lock Your Mortgage Rate Money

Best Mortgage Rate How To Get The Rates And Terms You Ll Love

Mortgage Rate Locks Everything You Need To Know Bankrate

Compare Mortgage Loan Terms 30 20 15 10 Year Mortgage Payment Calculator

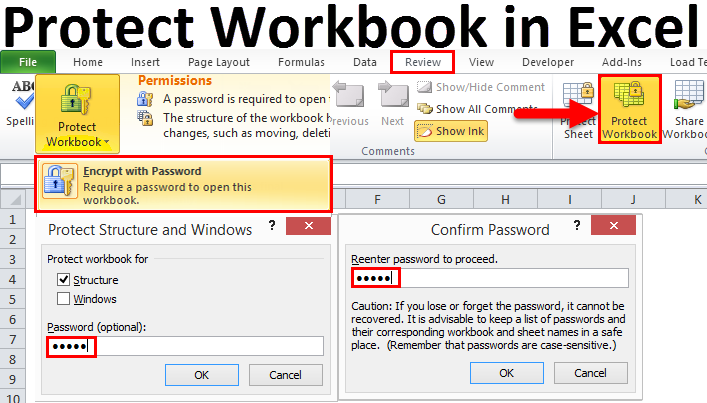

Protect Workbook In Excel How To Protect Excel Workbook

Mortgage Rate Lock When Do I Lock In My Interest Rate Nerdwallet